Sanctions Buster Iran Eyes Cryptocurrency To Blunt U.S. Deterrents

RFE

07 Aug 2018, 23:37 GMT+10

With real-world problems sparking a 'death spiral' for the rial currency, Iran's government is turning toward the cyberworld to help skirt U.S. sanctions that will further tighten the economic screws on Tehran.

The U.S. measures that took effect on August 7, four months after U.S. President Donald Trump pulled out of the Iran nuclear accord, are aimed at cutting off Tehran's access to U.S. dollars and stifling trade in key Iranian industries, including cars, aircraft, and Persian carpets.

Sporadic street protests against Iran's economic woes have put a human face on those and other challenges facing that country's religious leadership.

Get Adobe Flash Player Embed share 'Death To The Dictator': Protests Spread To Several Iranian Cities Embed share The code has been copied to your clipboard. width px height px The URL has been copied to your clipboard No media source currently available

0:00 0:01:25 0:00

So with currency and economic fears among the general populace becoming more palpable by the day, the Iranian government has tried to stifle the anger triggered by the White House's decision to leave the 2015 nuclear agreement by fighting to stem the rial's drop.

The creation of a cryptocurrency may be one way to ease the pain.

The underlying blockchain technology used in digital currencies eliminates the need for a third party, thus allowing for transactions to be made quickly, irrevocably, and in a secure environment.

Abolhassan Firouzabadi, secretary of Iran's Supreme Council of Cyberspace, said last week that a working group would be formed to discuss the launch of a virtual currency and that 'we are also planning to come up with a national and joint cryptocurrency for economic transactions with friendly countries.'

The statement came just days after Alireza Daliri, deputy for management and investment at the Directorate for Scientific and Technological Affairs, said a digital currency 'would facilitate the transfer of money [to and from] anywhere in the world. Besides, it can help us at the time of sanctions.'

Government U-Turn

Talk of a cryptocurrency is a stark about-face by the government, which had previously come out against public cryptocurrencies such as Bitcoin. In April, banks were banned from dealing with them altogether.

Authorities have yet to release any technical details, such as how to integrate blockchain technology with the central bank, though they have said it could be just a matter of months before a rollout to local commercial banks.

How the currency is set up will be an important factor in its possible success, according to Steve Hanke, a professor of applied economics at The Johns Hopkins University in Baltimore, Maryland, and one of the world's leading experts on hyperinflation.

'It would not be difficult for Iran to launch a cryptocurrency. The question is whether it would be successful or not,' he told RFE/RL, noting if it was fully backed by gold under a currency-board system, it could be a 'success.'

'As long as the international community accepted the new cryptocurrency as something of value, it would face no sanctions problems. And if it was a gold-backed cryptocurrency, it would be accepted by the international community,' Hanke, also director of the joint Troubled Currencies project with the CATO Institute, added.

Other analysts say Iran could follow in the steps of Venezuela, which in February launched the digital Petro -- raising $735 million so far for a currency that is backed by oil and is aimed at helping overcome sanctions from the European Union and the United States.

In the days leading up to the August 7 implementation of the U.S. sanctions, the rial weakened to an all-time low of 112,000 to the dollar on the black market, compared with the central bank's official rate of about 44,000 per dollar.

The drop, more than what it lost during the whole period of nuclear sanctions from 2012 to 2016, sparked worries among Iranians that their struggling economy will only worsen under the sanctions, further damaging the rial.

'Millions Are Panicking'

Since withdrawing from the agreement, Trump has fanned the flames by saying in a tweet that the U.S. won't tolerate Iran's 'demented words of violence & death' when responding to a warning that Iran's leadership made to the U.S. president.

But even before the pullout, Trump's saber-rattling had already prompted Iranians to seek safer places for their cash.

In the first five months of the year, Iranians acquired more than $2.5 billion worth of cryptocurrencies, according to local media reports.

Juan Villaverde, an analyst at Weiss Cryptocurrency Ratings, said a cryptocurrency appeals to those in countries lacking financial stability because their money stays out of the reach of the authorities who often implement financial controls that often results in devalued currencies.

'Millions of Iranians are panicking,' according to Villaverde.

'They fear not only renewed sanctions but also economic collapse and financial repression. Many are desperately looking for any viable way to leave the country. Many more are scrambling to find safe refuge for the little money they have left,' he added.

Alan Crosby

Alan Crosby is a senior correspondent for RFE/RL.

[email protected] Subscribe via RSS

Copyright (c) 2018. RFE/RL, Inc. Republished with the permission of Radio Free Europe/Radio Liberty, 1201 Connecticut Ave NW, Ste 400, Washington DC 20036

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Birmingham News news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Birmingham News.

More InformationBusiness

SectionEngine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...

Nvidia briefly tops Apple’s record in AI-fueled stock rally

SANTA CLARA, California: Nvidia came within a whisker of making financial history on July 3, briefly surpassing Apple's all-time market...

ICE raids leave crops rotting in California, farmers fear collapse

SACRAMENTO, California: California's multibillion-dollar farms are facing a growing crisis—not from drought or pests, but from a sudden...

Trump signals progress on India Trade, criticizes Japan stance

WASHINGTON, D.C.: President Donald Trump says the United States could soon reach a trade deal with India. He believes this deal would...

United Kingdom

SectionBritish PM faces major party revolt over welfare reforms

LONDON, U.K.: British Prime Minister Keir Starmer won a vote in Parliament this week to move ahead with changes to the country's welfare...

L'Oreal to buy Color Wow, boosts premium haircare portfolio

PARIS, France: L'Oréal is making a fresh play in the booming premium haircare segment with a new acquisition. The French beauty conglomerate...

UK lawmakers desigate protest group as terrorist organization

LONDON, UK - Lawmakers in the United Kingdom have voted overwhelmingly to proscribe the direct-action group Palestine Action as a terrorist...

Shell rejects claim of early merger talks with BP

LONDON, U.K.: British oil giant Shell has denied reports that it is in talks to acquire rival oil company BP. The Wall Street Journal...

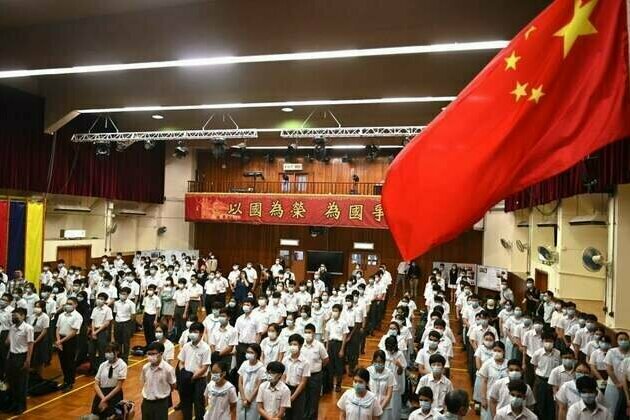

China: Building a 'Patriots Only' Hong Kong

(New York) - China's government has erased Hong Kong's freedoms since imposing the draconian National Security Law on June 30, 2020,...

Anupam Kher's 'Tanvi The Great' gets standing ovation from over 2,500 cadets at first screening

Pune (Maharashtra) [India], July 5 (ANI): The first screening of 'Tanvi The Great,' directed by actor Anupam Kher, was held on Saturday...