Dow Hits 2022 Low as Markets Sell Off on Recession Fears

Voice of America

24 Sep 2022, 03:25 GMT+10

Markets sold off around the world on mounting signs the global economy is weakening just as central banks raise the pressure even more with additional hikes of interest rates.

The Dow Jones Industrial Average closed Friday at its lowest point of the year. The S&P 500 fell 1.7%, close to its 2022 low.

Energy prices also closed sharply lower as traders worried about a possible recession. Treasury yields, which affect rates on mortgages and other kinds of loans, remained at multiyear highs. British government bond yields snapped higher after that country's new government announced a sweeping plan of tax cuts.

European stocks fell just as sharply or more after preliminary data there suggested business activity had its worst monthly contraction since the start of 2021. Adding to the pressure was a new plan announced in London to cut taxes, which sent U.K. yields soaring because it could ultimately force its central bank to raise rates even more sharply.

The Federal Reserve and other central banks around the world aggressively hiked interest rates this week in hopes of undercutting high inflation, with more big increases promised for the future. But such moves also put the brakes on their economies, threatening recessions as growth slows worldwide. Besides Friday's discouraging data on European business activity, a separate report suggested U.S. activity is also still shrinking, though not quite as badly as in earlier months.

'Financial markets are now fully absorbing the Fed's harsh message that there will be no retreat from the inflation fight,' Douglas Porter, chief economist at BMO Capital Markets, wrote in a research report.

Crude oil prices tumbled to their lowest levels since early this year on worries that a weaker global economy will burn less fuel. Cryptocurrency prices also fell sharply because higher interest rates tend to hit hardest the investments that look the priciest or the most risky.

Even gold fell in the worldwide rout, as bonds paying higher yields make investments that pay no interest look less attractive.

The Dow Jones Industrial Average fell 505 points, or 1.7%, to 29,572 and the Nasdaq fell 1.9% as of 3:43 p.m. Eastern. Smaller company stocks did even worse. The Russell 2000 fell 3%. U.S. crude oil prices slid 5.7% and weighed heavily on energy stocks.

More than 90% of stocks in the S&P 500 were in the red, with technology companies, retailers and banks among the biggest weights on the benchmark index. The major indexes are on pace for their fifth weekly loss in six weeks.

The Federal Reserve on Wednesday lifted its benchmark rate, which affects many consumer and business loans, to a range of 3% to 3.25%. It was at virtually zero at the start of the year. The Fed also released a forecast suggesting its benchmark rate could be 4.4% by the year's end, a full point higher than envisioned in June.

Treasury yields have climbed to multiyear highs as interest rates rise. The yield on the 2-year Treasury, which tends to follow expectations for Federal Reserve action, rose to 4.19% from 4.12% late Thursday. It is trading at its highest level since 2007. The yield on the 10-year Treasury, which influences mortgage rates, slipped to 3.68% from 3.71%.

The higher rates mean Goldman Sachs strategists say a majority of their clients now see a 'hard landing' that pulls the economy sharply lower as inevitable. The question for them is on the timing, magnitude and length of a potential recession.

In the U.S., the jobs market has remained remarkably solid, and many analysts think the economy grew in the summer quarter after shrinking in the first six months of the year. But the encouraging signs also suggest the Fed may have to raise rates even higher to get the cooling needed to bring down inflation.

Some key areas of the economy are already weakening. Mortgage rates have reached 14-year highs, causing sales of existing homes to drop 20% in the past year. But other areas that do best when rates are low are also hurting.

In Europe, meanwhile, the already fragile economy is dealing with the effects of war on its eastern front following Russia's invasion of Ukraine. The European Central Bank is hiking its key interest rate to combat inflation even as the region's economy is already expected to plunge into a recession. And in Asia, China's economy is contending with still-strict measures meant to limit COVID infections that also hurt businesses.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Birmingham News news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Birmingham News.

More InformationBusiness

SectionWall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

DIY weight-loss drug trend surges amid high prices, low access

SAN FRANCISCO, California: Across the U.S., a growing number of people are taking obesity treatment into their own hands — literally....

Apple allows outside payment links under EU pressure

SAN FRANCISCO, California: Under pressure from European regulators, Apple has revamped its App Store policies in the EU, introducing...

Euro, pound surge as U.S. rate cut odds grow after Powell hint

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and...

United Kingdom

SectionAmazon still trails UK grocers on fair supplier treatment

LONDON, U.K.: Amazon has once again been rated the worst major UK grocery retailer by its suppliers when it comes to following fair...

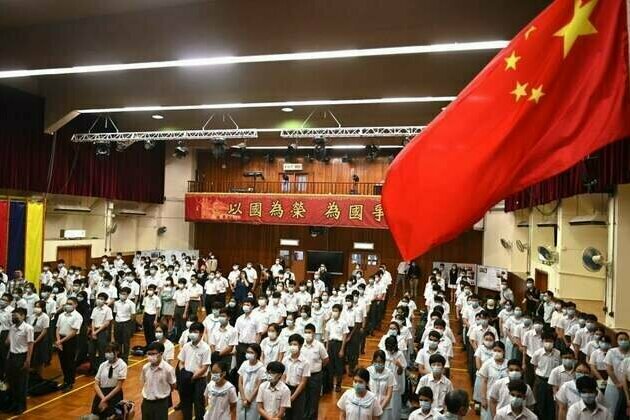

China: Building a 'Patriots Only' Hong Kong

(New York) - China's government has erased Hong Kong's freedoms since imposing the draconian National Security Law on June 30, 2020,...

TRKIYE-ANKARA-FM-BRITAIN-FOREIGN SECRETARY-PRESS CONFERENCE

(250630) -- ANKARA, June 30, 2025 (Xinhua) -- Turkish Foreign Minister Hakan Fidan (R) and British Foreign Secretary David Lammy hold...

Xupan: A step towards strengthening sustainable livelihoods for HEC-hit villagers in Eastern Assam

Guwahati (Assam) [India], June 30 (ANI): The region's premier biodiversity conservation organisation, Aaranyak, has been working tirelessly...

Doeschate confirms Bumrah's "availability" for Edgbaston Test, but yet to take decision to play him or not

Birmingham [UK], June 30 (ANI): India assistant coach Ryan ten Doeschate confirmed pace spearhead Jasprit Bumrah is 'available' for...

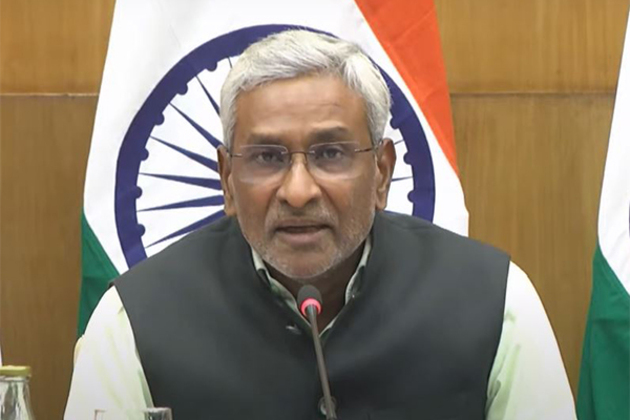

Indian community in Trinidad &Tobago enthusiastic about PM Modi's upcoming visit: MEA Secy

New Delhi [India], June 30 (ANI): Prime Minister Narendra Modi will travel to Trinidad and Tobago on a two-day visit from July 3 as...