Citigroup mistakenly credits $81 trillion to customer instead of $280

Robert Besser

04 Mar 2025, 11:57 GMT+10

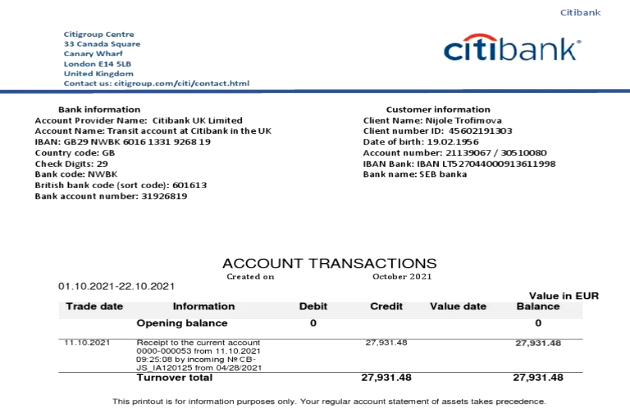

- A routine banking transaction at Citigroup last April turned into a major blunder when the bank mistakenly credited $81 trillion to a customer's account instead of US$280

- The error, which took hours to reverse, was caught internally before any funds left the bank, but it underscores persistent operational challenges Citigroup has been working to address

- According to the FT report, two employees responsible for reviewing the transaction initially missed the mistake before it was processed the next day

NEW YORK CITY, New York: A routine banking transaction at Citigroup last April turned into a major blunder when the bank mistakenly credited $81 trillion to a customer's account instead of US$280, according to a report by the Financial Times (FT) this week.

The error, which took hours to reverse, was caught internally before any funds left the bank, but it underscores persistent operational challenges Citigroup has been working to address.

According to the FT report, two employees responsible for reviewing the transaction initially missed the mistake before it was processed the next day. A third employee finally caught the issue an hour and a half later, prompting the bank to reverse the incorrect credit several hours after it had been processed.

Citigroup disclosed the incident—which qualifies as a "near miss" because no funds were lost—to U.S. regulators, including the Federal Reserve and the Office of the Comptroller of the Currency (OCC).

In response to inquiries, a Citi spokesperson told Reuters that the bank's "detective controls" quickly identified the ledger entry mistake and reversed it before it could impact the customer or the bank.

This isn't the first time Citigroup has faced scrutiny over its risk management systems. According to an internal report reviewed by the FT, Citigroup recorded 10 near misses of $1 billion or more in 2023, down slightly from 13 the previous year.

The bank has been under regulatory pressure to improve its internal controls. In 2020, Citi was fined $400 million for issues related to risk management and data governance, and in July 2023, it was fined an additional $136 million for failing to make sufficient progress in fixing those shortcomings.

Citigroup's Chief Financial Officer Mark Mason acknowledged last month that the bank is investing more in technology, data management, and compliance to strengthen its risk oversight.

"We saw the need to invest more in the transformation on data, on technology, on improving the quality of the information coming out of our regulatory reporting," Mason said.

Citigroup continues to strengthen its internal processes to reduce the frequency of such high-stakes errors. While the $81 trillion mistake was caught in time, it serves as a reminder of the risks associated with large-scale banking operations—and the importance of robust oversight mechanisms.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Birmingham News news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Birmingham News.

More InformationBusiness

SectionMeta plans paid subscription for AI chatbot

MENLO PARK, California: Meta Platforms is gearing up to introduce a paid subscription service for its AI-powered chatbot, Meta AI,...

China’s factory slump continues, raising stimulus calls

BEIJING, China: China's manufacturing sector is expected to shrink for a second consecutive month in February, signaling continued...

U.S. stocks join global rout over trade war fears

NEW YORK, New York - U.S. stocks dived, then partially recovered Tuesday as 25 percent import duties on goods from Canada and Mexico...

Tesla moves closer to robotaxi launch with California permit bid

AUSTIN, Texas: Tesla has taken a key step toward launching its long-promised robotaxi service by applying for a transportation permit...

US pending home sales in January hit record low amid high rates

WASHINGTON, D.C.: Contracts to buy previously owned homes in the U.S. fell to a record low in January due to high mortgage rates and...

Citigroup mistakenly credits $81 trillion to customer instead of $280

NEW YORK CITY, New York: A routine banking transaction at Citigroup last April turned into a major blunder when the bank mistakenly...

United Kingdom

SectionGatwick set for second runway as UK greenlights expansion

LONDON, U.K.: The UK government has tentatively approved the expansion of Gatwick Airport, paving the way for a second runway, drawing...

Rwanda demands $63 million from UK - media

Kigali has requested compensation after the cancelation of an asylum agreement, arguing that Britain has broken mutual trust ...

Vances comment on troops in Ukraine sparks anger in UK

A deal with the US is a better security guarantee for Kiev than troops from a country that hasnt fought in decades, according to the...

Explainer: How do five-year plans drive China's comprehensive development?

The opening meeting of the third session of the 14th National People's Congress (NPC) is held at the Great Hall of the People in Beijing,...

India expands UK footprint as GBP 41 billion partnership boosts growth

New Delhi [India], March 5 (ANI): The India-UK partnership is set to strengthen significantly as External Affairs Minister S Jaishankar...

AgustaWestland VVIP scam: Christian Michel's lawyer speaks on bail conditions, passport renewal process

New Delhi [India], March 5 (ANI): Advocate Aljo K Joseph, representing Christian Michel, a key accused in the AgustaWestland VVIP chopper...